Introduction

The integration of technology in all aspects of the banking industry is what digital transformation in banking refers to to enhance the customer experience, improve efficiency, and increase security. With advancements in technologies such as blockchain, artificial intelligence, and cloud computing, traditional banking institutions are being forced to adapt to stay relevant in a rapidly changing financial landscape.

Numerous opportunities are presented to businesses by the banking industry’s digital transformation. Their financial operations can be streamlined and made more efficient through faster, more secure transactions and improved access to financial services. Technology for risk management and data analysis can also offer insightful information about how well a business is performing and help with decision-making.

But there are drawbacks to banking’s digital revolution. A few of the issues that must be resolved include cybersecurity hazards and the requirement for a competent personnel to manage and execute new technology. To maintain compliance with rules and the privacy of client data, businesses and banks must collaborate.

Key factors driving Digital Transformation in Banking

The rapid modernization of digital tools & technologies, improved network connectivity, and increase in smart gadgets are driving digital transformation trends, irrespective of the different end-user bases and other factors.

Let’s get deeper into the trends:

● Customer demands and expectations: Customers are increasingly relying on digital channels for banking and financial services, which is driving the need for banks to adopt digital technologies to improve their customer experience, ease of doing transactions, seamless query disintegration, and security.

That is a big reason why the banking system is moving to digital platforms.

● Competition: Banks face competition from new digital-first entrants, as well as traditional financial institutions that are also investing in digital transformation.

● Regulatory changes: Government regulations are promoting the use of digital technologies in the financial industry, such as open banking initiatives that encourage banks to make customer data more accessible to third-party providers.

● Improved operational efficiency: Digitization of banking processes and systems can help banks to streamline their operations and reduce costs.

● Data and analytics: Banks have access to vast amounts of data, and leveraging advanced analytics can help them to understand customer behavior better and preferences, and improve decision-making.

● Technological advancements: The development of new technologies, such as artificial intelligence and blockchain is enabling banks to offer new products and services, as well as improve existing ones.

The shift from traditional to digital banking & its benefits in points:

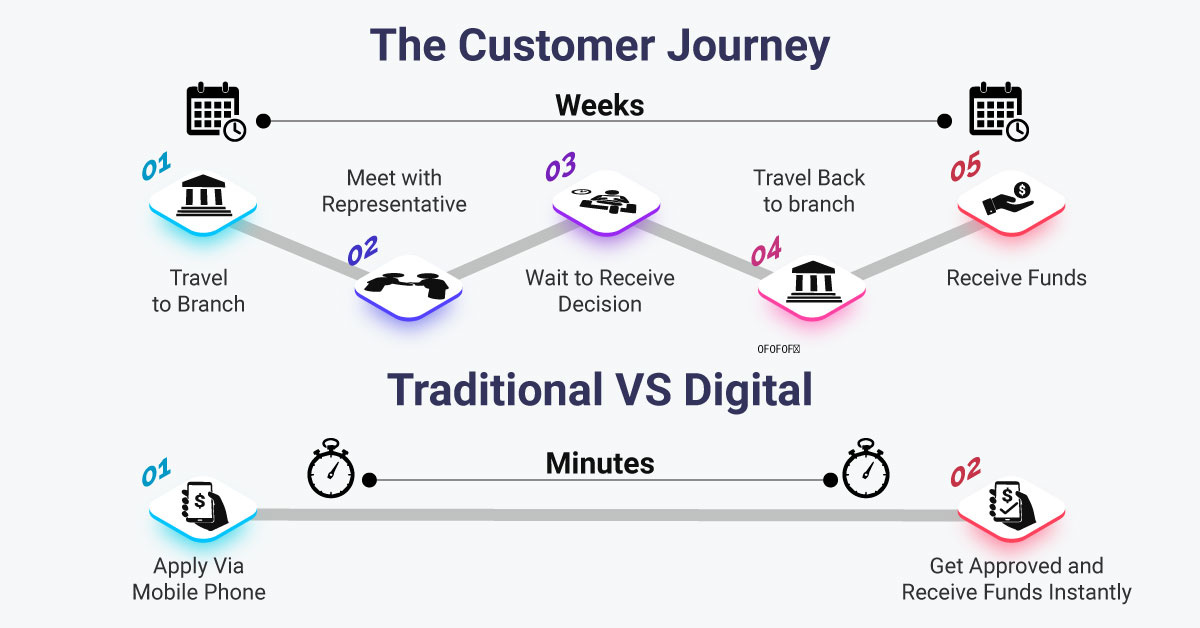

● Changing customer preferences and behaviors: Customers are increasingly relying on digital channels for banking services and expect a convenient, accessible, and personalized experience.

● Advancements in technology: Technological advancements, such as online and mobile banking, digital payments, and advanced data analytics, are enabling banks to offer new and improved products and services.

● Cost savings and improved efficiency: Digitization of banking processes and systems can lead to cost savings and improved operational efficiency.

● Growth of digital-only banks: The shift towards digital banking has led to the growth of digital-only banks, which often offer lower fees and higher interest rates than traditional banks.

● Digitization of traditional banks: Traditional banks are investing in digital transformation to stay competitive and meet the evolving needs of their customers, including the digitization of their processes and systems.

Digital technologies utilized by modern banks

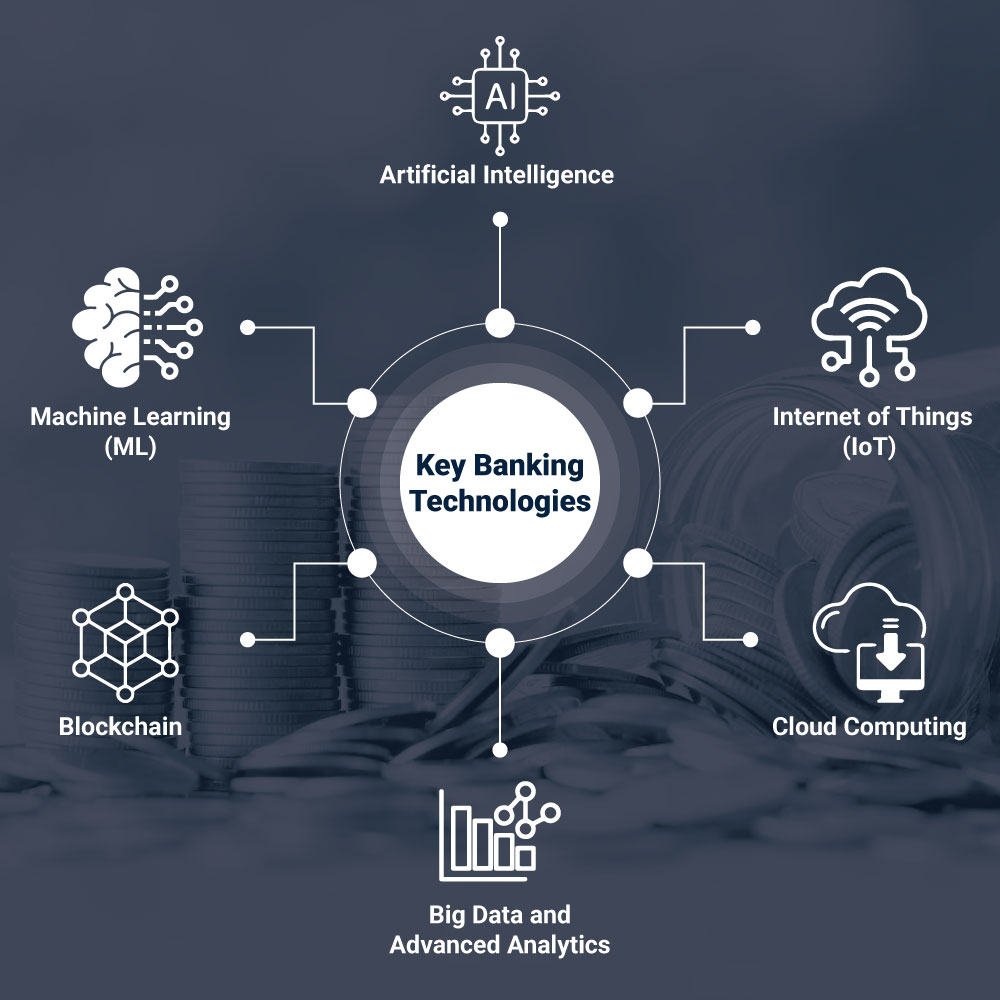

As we know the past pandemic of Covid-19 was a massive hit to the globe which has also accelerated the need for digital transformations in the banking sector. Adopting the cloud technologies such as blockchain, cloud computing, and IoT, are the true transformation of digital banking.

The heart of any strategy at the end is the customer.

Let’s understand the tools and technologies utilized by the digital banking sector:

● Improved customer experience: Digital transformation can enhance the customer experience by providing more convenient, accessible, and personalized banking services, including online and mobile banking, digital payments, and real-time access to account information.

● Artificial intelligence (AI) and machine learning (ML): The use of chatbots for online assistance of customers’ issues has resolved the monotonous working system. Along with this, AI is also used for the security of data, data analysis, and management and for improving customer experience.

On the other hand, ML in the banking sector can adopt to detect fraud and help to take preventive measures accordingly.

● Internet of Things (IoT): IoT brings on-demand customer service nearer to them. IoT offers customers data that help banks to understand their behavior and needs for personalized services for each customer.

Banks are exploring the use of IoT technology to collect and analyze data from connected devices, and to provide customers with innovative new products and services.

● New revenue streams: Digital transformation can enable banks to launch new products and services, such as digital payments and financial wellness programs, creating new revenue streams.

● Blockchain: Adopting digital technologies such as blockchain can give banks a competitive advantage by improving the customer experience as well as increasing operational efficiency. The blockchain has offered more accuracy, transparency, and better security to transactions.

● Cloud Computing: Banks are utilizing cloud computing to store and manage vast amounts of data, improve productivity as well as to scale their operations, and reduce costs.

● Big Data and Advanced Analytics: Banks are leveraging big data and advanced analytics to understand customer behavior better and preferences, and to make informed decisions about product development and risk management.

Benefits of digital transformation in banking and what it means for businesses

Investment banking on the digital platform

The growth of digital banking has led to fewer intermediary steps, greater data transparency, and alternate ways to obtain knowledge. All of these elements reduce operating costs and facilitate quicker and smoother transactions. Investment banks have been supplanted by small investors gathered on a single, centralized digital platform because of, banking digitization.

This is excellent news for digital organizations and businesses because the digital transformation has also forced investment banks to concentrate on short-term objectives and let urgent client requirements dictate their technological expenditures.

Compliance

With the advent of the contemporary digital financial management system, compliance has become simpler for banks to maintain. Employees spend less time auditing reports and documents thanks to advanced capabilities like auto auditing. Digital data maintains its standardization and can be flawlessly exchanged across several systems.

Additionally, the cloud-based digital payroll system provides fast updates, so banks do not need to worry about keeping up with changing requirements.

Easier acquisition of new customers

Customers and businesses both need each other’s services. Financial institutions are no longer apathetic about their offerings, making it cheaper and simpler to draw in new clients for all industries, not just banks. Every client and company may function without hassles. Thanks to rapid online payment.

Business innovation and adaptability

Banks and other businesses now have more ways to connect with their clients because of the rise of social media, e-commerce websites, and mobile banking applications. Due to the banking industry’s digitization, numerous new company developments now depend heavily on financial services.

Enhanced security

One of the tough problems that businesses and organizations are battling to solve is the security of customer data. Banks can now use sophisticated software development services to safeguard sensitive data and secure customer accounts from fraudsters, cyberattacks, phishing, and other threats.

Personalized offerings

Banks can now provide customers with the exact services they require; thanks to the digital transformation of banking and financial services. This is by far the biggest advantage of digital banking for its users because financial institutions have started developing their goods and offer according to the customer’s daily expenses instead of relying on guesswork.

How iTechtions can help you leverage digital transformation in your Business?

Our vision is to overcome the challenge by fulfilling digital requirements for digital transformation. And decentralized technology, AI, Cloud solutions, and business automation are the need of the hour. By overcoming the biggest challenge of building digital transformation solutions, we ensure you provide competitive business solutions.

Final Thoughts

For businesses, #digitaltransformation in banking means increased access to financial services, improved speed and efficiency of transactions, and the ability to use data and analytics to make informed financial decisions. It can also lead to lower costs and the creation of new revenue streams, as well as a more personalized and convenient banking experience for businesses.

Digital transformation in banking is essential for businesses to stay competitive and provide the best possible customer experience. Banks and businesses must work together to navigate the challenges and harness the benefits of this digital revolution. The future of banking is digital, and those who embrace it will be well-positioned for success.